A Central EU Tax is not Superior to the Status Quo

The discussion about how to finance the budget of the European Union has a long history. The current system of national contributions, which are largely based on the member states’ gross national incomes, is criticized as being full of exceptions, overly complex and outdated. The discontent has led to the implementation of a High Level Group that has the mission to deliver recommendations until the end of 2016 for more transparent, simple, fair and democratically accountable ways to fund the EU. Meanwhile, there are continuing and persistent pressures towards the implementation of a genuine EU tax as a substitute to national contributions. In a recent publication, Alfons Weichenrieder, Professor of Economics and Public Finance at Goethe University, and Vilen Lipatov, Compass Lexecon Brussels & CESifo, analyze the conditions under which such a transition would make sense economically.

The allocation of taxation rights is an ongoing issue in fiscal federalism theory. A long-standing argument put forward in the literature is to assign sales taxes and taxes on immobile tax bases to lower-level governments and to reserve the more mobile tax bases to the central level. This way, fiscal externalities that may occur if lower-tier governments are using mobile tax bases could be avoided.

The advantages of decentralized taxation

The analysis shows that decentralized taxation is superior to uniform central taxation for financing a central budget if spillover effects are absent and the size of the central budget is given. The reason is that decentralized taxation can better cater to differences in behavioral reactions to taxes, differences in regional redistributive preferences and different attitudes towards administrative issues. In this decentralized solution the central government decides on the sum of contributions whereas the member states decide on the tax instruments to be used for raising the contributions. This mechanism actually resembles the current setting in the EU.

In a second step, the authors introduce spillover effects of regional taxes to the analysis and discuss the amount of tax coordination this requires. They find that a system with coordination on the tax instruments used at the decentralized levels plus centrally set regional contributions is preferable to a centralized tax as long as spillover effects between regions do not depend on the intra-regional distribution of the tax burden. Only if this restriction does not hold, a centralized tax may be superior and better internalize spillover effects than coordination.

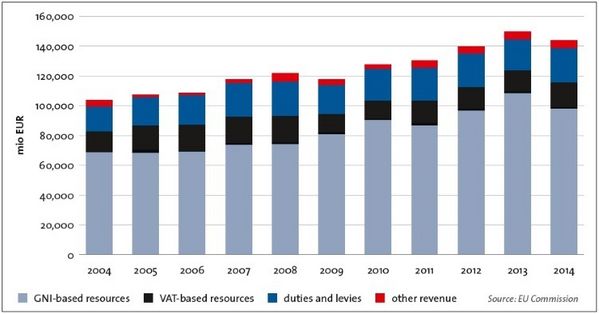

EU budget from 2004 to 2014: revenues from gross national income (GNI)-based resources, VAT-based resources, duties and levies, and other revenues (2004-2012: EU27, 2013-2014: EU28)

Tax coordination instead of uniform taxation

The results have interesting implications for the current discussion. They suggest that any plan to introduce an EU-wide tax faces a clear trade-off between the gains of harmonizing the tax base and the losses stemming from the impossibility to levy taxes that fit local preferences best. Thus, the current system in the EU risks adverse effects when member states decide to levy taxes that are optimal from a local perspective but suboptimal from a union-wide welfare function. In this case, the optimal response may be to restrict the regional choice of tax instruments rather than to centralize taxation altogether: Limiting the choice of the member states to the set of tax bases that have least interstate spillovers would minimize the negative effects of decentralization.

Taken to the extreme, the EU might want to prescribe which exact tax base each member state should use and only leave the distribution of the contributions within this tax base at the disposal of the national government, the authors suggest. Such a measure would still allow sufficient leeway to cater to regional preferences. There are, for example, various possibilities to raise the same revenue from the same set of incomes or to set a VAT, with different goods and services exempted and others taxed at reduced rates. Unlike an EU tax, restrictive conditions regarding the tax base could still exploit the efficiency of a decentralized solution while curbing interstate externalities.

Lipatov, V., Weichenrieder, A. (2016): “A Decentralization Theorem of Taxation”, forthcoming in CESifo Economic Studies