The Effects of CoCo Bonds on Insurers' Capital Requirements

The Liikanen Group proposed contingent convertible (CoCo) bonds as instruments to enhance financial stability in the banking industry. Especially life insurance companies could serve as CoCo bond holders. There is a rising awareness of these hybrid securities among life insurers, as they are increasingly looking for higher-yielding investments during the current low interest rate period. Helmut Gründl, Professor of Insurance and Regulation at Goethe University, and his assistant Tobias Niedrig analyzed how CoCo bonds should be designed in order to be attractive for life insurers.*

CoCo bonds are a form of long term debt with a fixed coupon rate that automatically convert to equity when a bank approaches insolvency, i.e. when a predetermined trigger is met. Upon conversion, a bank immediately replenishes its equity capital base, while at the same time reducing its interest payment obligations.

To maximize the stabilizing effect on the financial system, CoCo bond holders may not hedge themselves in the banking sector and should not experience refinancing difficulties when suffering losses on their investments. Diversified financial institutions with long term maturities on their funding side and restrictive termination rights, such as life insurance companies, seem to fit this profile.

CoCo bonds under Solvency II

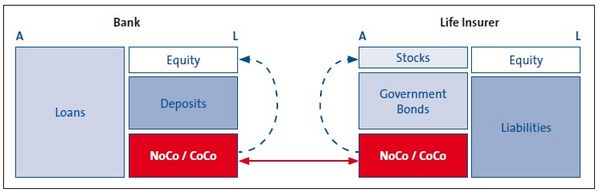

The authors calculate the effects of holding CoCo bonds on life insurers' risk-based solvency capital requirements under the European Solvency II standards that come into power by 2016. They develop a stylized model with a direct financial connection between banking and insurance (see figure). The bank provides loans that are financed by equity capital, deposits and additional bank debt (either non-convertible or contingent convertible). The financial connection between banking and insurance stems from the insurer’s investment into the bank’s bonds.

Financial connection between bank and insurance company

The paper studies a variety of CoCo bond designs and allows for partial conversion which has important implications for investors: as CoCos convert to equity, bond holders become shareholders and thus share any costs or benefits that accrue to shareholders from subsequent conversions. To assess the effect of the conversion on insurers' capital requirements, besides using the Solvency II standard model, the authors develop an internal model that ex-ante anticipates possible future bank share holdings. From the resulting capital requirements for insurers, they study the sensitivity with respect to the CoCo bond design (trigger value, conversion ratio, holding time of bank shares) and the bank's risk appetite.

Capital requirements for different CoCo bond types

Since the current standardized assessment of market risk depends on relatively crude risk weights, the Solvency II standard model is not able to reflect the entire risk profile of a CoCo bond. In contrast, an internal model can recognize the full risk return profile through dynamic modeling techniques and therefore evaluate the actual risk situation of the company. By varying the CoCo bond's trigger value and the conversion ratio as well as the bank's risk appetite, the authors find that the standard model can mislead CoCo investors and produce economically unsound incentives. For example, by increasing the trigger value, capital requirements under the Solvency II standard model wrongfully decrease, while they increase under the internal model.

According to the internal model, capital requirements for CoCo bonds increase with increasing trigger value, decreasing conversion ratio as well as increasing bank risk. In addition, CoCos lead to higher capital charges than non-convertible bonds if bank risk is low, and to lower capital requirements if bank risk is high. For high bank risk, insurers clearly benefit from buying CoCos due to lower capital charges and a higher coupon rate.

Policy Implications

The results of this paper show which design makes CoCo bonds an attractive investment category for life insurers. The current set-up and calibration of the Solvency II standard formula for market risk are inadequate with respect to the treatment of contingent convertible bonds. By highlighting these weaknesses of the market risk module, the results provide an indication for improving it.

* Gründl, H., Niedrig, T. (2015): “The Effects of Contingent Convertible (CoCo) Bonds on Insurers’ Capital Requirements Under Solvency II”, forthcoming in the Geneva Papers on Risk and Insurance: Issues and Practice.